WELLI-MULTI CORPORATION-OPTIMUS PRIME

WELLI-MULTI CORPORATION-OPTIMUS PRIMEIn April 2007, a group of politically connected corporate leaders took over a small second board company, Four Seasons. Their intention-to bring to fruition the vision of PM Abdullah that Malaysia will be the international Halal Hub for the OIC. A kind of national service to Malaysia.

So they hi-tailed Dr Rashid Tang Abdulah back from their Hadhari cattle operations in Inner Mongolia to helm Welli-Multi Coporation (WMC). The next corporate move-Hadhari Cattle Industry buys 19 % of WMC at RM1.50.

WMC then move into high gear.

First stop: to set up the biggest halal gelatin plant in the world in Malaysia. There is currently no significant 100% halal gelatin producer in the world.

And why gelatin?

Gelatine is used in pharmaceuticals, foods, photography and many industrial applications. For religious and hygiene reasons, the demand for halal gelatine is expected to be in high demand especially in Islamic countries (OIC). Venturing into this project is therefore in line with the Malaysian government's initiative to be the world's Halal Hub Centre. The world market for gelatine is estimated at 315,000MT valued at over USD 2 billion.

WMC then engaged, Imtech Drygenic, a Dutch firm to design a gelatine plant to produce 5,000 metric tonnes of gelatine per annum. The plant to be located in Kedah, will commence operations in mid-2008. Hadhari Cattle Industry Malaysia will supply the cattle bone for making the halal gelatine.

Next, it commissioned Erawat Engineering, an Indian company, to supply WMC with halal gelatin capsule making equipment at its present plant in Prai Industrial Estate. The equipment will be able to produce 5bil capsules a year.Production is scheduled to begin in early 2008.

Second Stop: A Foray into Inner Mongolia

On 8th July 2007, WMC signed an agreement with the Inner Mongolian Government on to cooperate in energy, mining,metals, roads and sundry developments. It is now negotiating to buy over at least 30 % of Chi Feng Dasi Basic Industry, currently traded on Shenzhen. Dasi's main involvement are in mining and metals (silver and gold) as well as in tolled road developments in Inner Mongolia. Its revenue is RM1 billion yearly.

My reading:

WMC and Hadhari Cattle Industry (HCI) are synonymous. In time, HDI will reverse take-over WMC. When CEO Rashid talks, he talks on behalf of both WMC and HCI.

Tomorrow, PM Abdullah will unveil the NCER masterplan. Most of the projects to be announced are already speculated and only the finer details matter. To those in the know, close to the heart of the Premier is his pet Halal Hub Project and in the pilot seat is WMC.

The Stock:

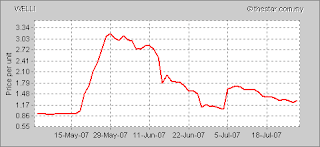

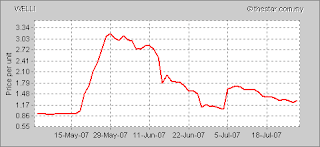

WMC is ready To Move Up. The weather outside ocassioned by typhoon Dow Jones is not conducive.

Like a yoyo, it went up and down from April to June. Prices went down on attrition buying in July. It stands currently at RM 1.29.

WMC prices were capped from going up chiefly because of SC’s sanction on the release of its quarterly report. Apparently they were worried at the huge amount of receivables.CEO Rashid however gave an assurance that this was manageable and will be collected by March 2008. Legal action will be taken as warranted.

Most investors bought at the RM1.45-RM1.70 level. Only weak holders have thrown their shares. The parties who bought huge chunks are keeping it under wraps. They are waiting for a price resurrection. That time is near.

My Take:

Crystal gazing, barring unforeseen market conditions, WMC stock prices should move up if and when:

- PM's unveiling of the NCER on 30 and 31 July 2007

- The Annual Report and quarterly reports are vetted and approved by SC-very soon I hope

- WMC buys the Dutch gelatin production technology and machinery

- WMC buys the halal capsule producing machines from India

- Confirmation of stake and price in Chi Feng Dadi Basic Industry Co. Ltd.

- Potential buy of WMC shares by by Siping Lishan Machinery Manufacturing Company of China at an agreed price higher than RM1.50 per share

- Potential buy of WMC shares by a GLC(possibly Synergy Drive)

- Potential buy by a Kedah State Investment agency

- Purchase of shares by a politically connected bumiputra entrepreneur (either from Penang or Kedah)

- Purchase of shares by an international investor form the Middle-east (possibly Kuwait Finance Corporation)

- Reverse take-over of WMC by Hadhari Livestock Corporation and friendly parties

Believe me, all the above, if it does materialises, will be event-managed.

So, if you are game, do some homework and take a position on WMC.

Heartsong