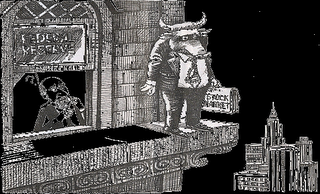

The Bulls May be Off to Bali....

The Bulls May be Off to Bali....

Dow was ambivalent. US Treasury bills yields have risen. The Feds have injected more money into the market to alleviate the tight fund situation for bill buying. Flight from money-backed securities into Treasury bonds continues. More are of the opinion that the Feds will not cut the rate on September 18 as selling pressure ebbs on Wall Street and there is less fear all round on the sub-prime. Oil prices are trending downwards as Hurricane Dean loses its sting.

Meanwhile, in the east, China increases its interest rate and allowed for the first time for individuals from mainland China to buy shares off Hong Kong. The early furor has somewhat died down but I expect demand will go up once the mainland Chinese investors gets savvy enough to trade in HK shares.

The Japanese yen continues to trade higher especially against the NZ$ and the Aussie$ as the carrying trade unwinds. As long as this continues, yen will move forward. Many are speculating that the BOJ will not increase interest rate for the time being.

Back home, market closed 1% lower yesterday, brought down particularly by the selling down of Genting which has been grossly oversold and should bounce back. If at all, the market can come back on its own, it will be led by the tandem leadership of the Genting-Resort pair. External help can come in the form of a coordinated push by Value Cap and its GLC sister funds. If the move can counter foreign fund selling, we should be back on course for a rally before the September 8 Budget. If not, this is one year where we are denied that bullish phase.

My reading today before the market opens: Lackadaisical trading pattern with a downward bias to hold cash and the omnipresent "wait and see" non-committal stance. This will cause low volume trading and sap away excitement sentiments from our market.

The bulls are away in Bali and in exotic places like Aruba. Expect two boring sessions today.

Heartsong